Aspirin can’t fix these, but data can!

It’s no secret that legal bills are notoriously opaque and hard to understand. They can be incredibly frustrating, often subjecting in-house teams to countless hours of interpretation as they seek to clarify everything from inaccurate tagging to misapplied or missing discounts.

Here are the three most common legal billing headaches and tips for how to avoid them:

1. Inconsistent Discount Application

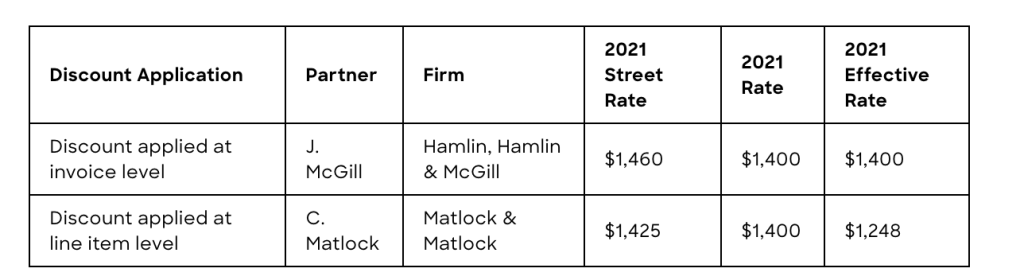

When it comes to invoicing, law firms don’t make it easy to understand if you’re actually paying the rates you agreed to during rate card negotiation. Discounts are often at the heart of the issue. Frequently applied inconsistently, discounts can make it a real challenge to identify the difference between gross rates versus net rates versus write-offs.

While one firm might apply line item discounts, another might apply a bulk discount to the entire invoice. Clients are often left in the dark in terms of understanding when – or even why – these discounts are applied. Compound that with the fact that most in-house teams don’t have a real-time view into their actual rates with each firm – so forget visibility on the agreed discounts by practice area for each firm!

Pro Tip: Require street rates, relationship discounts, practice area discounts, and write-offs to be broken out in each line item. This will prevent inconsistencies and the fuzzy math that might make a partner at a cheaper firm more expensive due to discounts being applied at the invoice level. Additionally, line item discounts will help you clarify your effective rates by allowing you to calculate the impact on a more granular basis, say by practice area or timekeeper level.

Example:

2. Unstructured Data & Inaccurate Tagging

Taxonomy, or how things are organized into categories and hierarchies (or in this case, not organized!), is foundational to any kind of data analysis. For example, whether a cardiologist conducts a heart catheterization in Phoenix or Seattle, it’s coded and organized the same way for any insurance carrier.

Unfortunately, there is no universally accepted taxonomy for legal matters, and legal departments and firms can vary widely in how they organize matters. This concept is often referred to as “garbage in, garbage out”.

This is often the reason for the huge discrepancies between rates from firm to firm in what appears in legal spend reporting to be the same practice area. Aside from being just plain confusing, the resulting communication gap has created a systemic issue that makes it very difficult to confidently compare one firm to another — even when the data is telling you that the matters are similar.

Pro Tip: Create a framework that accommodates the majority of your legal matters. Make it simple and try to apply it to every invoice you receive. A standardized matter taxonomy, coupled with accurate tagging, enables the critical apples-to-apples comparisons you need to confidently analyze everything from your rates to staffing. Plus, this will lay the groundwork you need to prove how valuable the data can be in everything from rate negotiation to invoice review automation.

3. Missing Data & Absent Tagging

Another consequence of not having a standard taxonomy is how easily things can be missed. For example, let’s say you want to find out the effective rate by firm for all of your complex litigation matters from last year. If all your matters aren’t tagged properly as complex litigation, you might end up with effective rates much higher or lower than you actually paid.

That kind of error can lead to pretty big consequences when it comes to setting a benchmark for rate negotiation. An inflated rate due to missing data might trick you into normalizing a rate increase.

Missing data keeps corporate legal departments from formulating meaningful quantitative conclusions ultimately leading to uninformed decisions that can be detrimental.

Pro Tip: Bodhala can help corporate legal departments define and collect this information and apply such criteria to historical bills to build a standard taxonomy. Equipped with this information, in-house teams can measure the variance across practice areas to determine the complexity of the matter as well as the efficiency and effectiveness of the timekeepers.

Savvy in-house teams are demanding more transparency in an effort to eliminate these billing headaches and break through the status quo.

But do you have the data needed to lead this charge?

—

Get in touch with our team of legal billing and data experts to find out how Bodhala can transform your legal department.