Our clients tell us every day about their challenges budgeting for outside legal counsel. Every year their law firms impose higher rates causing our clients to find more money to cover the increased cost.

Law firms have historically had overwhelming pricing power in the market — far out of proportion to what they deserve in a properly functioning market. They have been able to set their prices and demand clients pay their rates.

It’s evident this power has been wielded irresponsibly. And it’s gone on for decades.

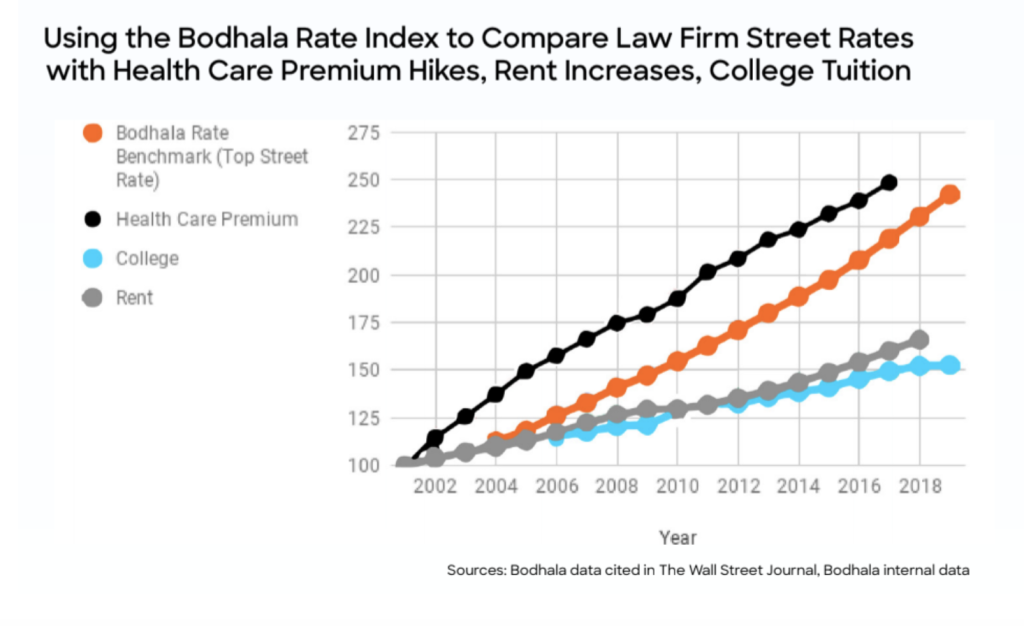

Since the financial crisis in 2008, law firm partner rates at the most prestigious firms have increased more than 72 percent, according to Bodhala data.

With increased pressure to control operating expenses for high-stakes legal matters, corporate legal departments are forced into acting like Sisyphus, pushing a boulder uphill every year trying to stay under budget with little control over the rates they pay to outside firms.

Law firms have justified their rate increases with a series of talking points related to the cost of goods sold — increasing real estate costs, higher salaries to associates, lower realization rates, and fear of losing their partners, among others. Firms have claimed that they are passing the costs of their business onto their clients. But when you look at the data, there is no justification for price increases other than to boost firm profits.

We were interested in this reality and dug into the market looking for trends. What we’ve found validates our assumptions.

We researched law firm billing rates from the turn of the century to now and compared it to the market at large. Interestingly, the findings revealed that, relative to inflation, law firm street rates have greatly outpaced hikes in the costs for college and average rent, and only barely lagged health care premium increases.

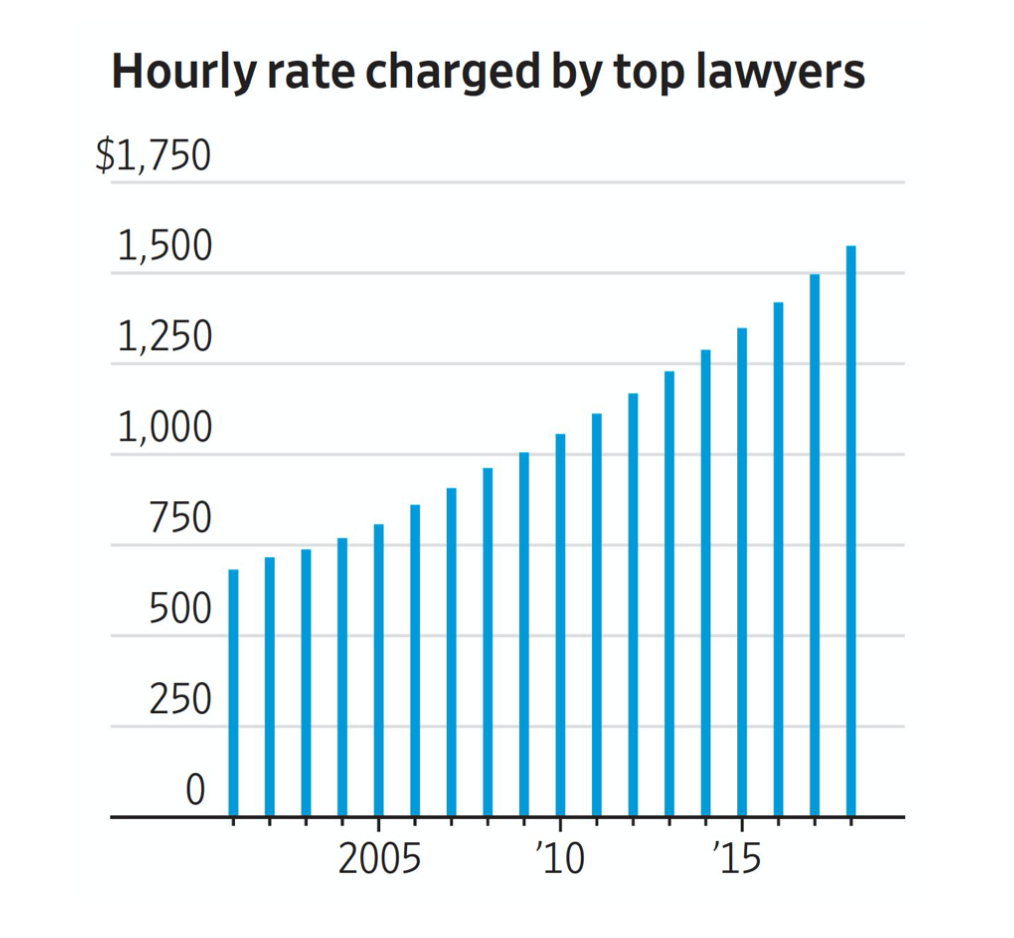

The Bodhala Big Law Partner Index

As you can see, these elite partners have seen their rates increase dramatically, right through the Great Recession. Has this been the case in any other market? Other than in monopoly or other non-competitive markets, do CEOs get the power to increase prices by 5-12 percent every year as a matter of course?

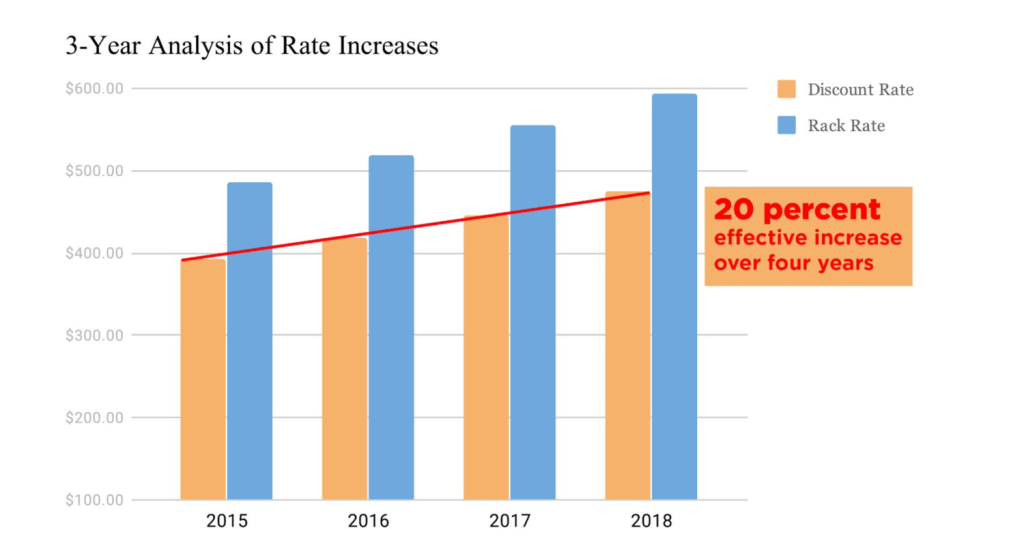

The Current Market: Compounding Rates

Albert Einstein called compounding interest the 8th wonder of the world. “He who understands it…earns it. He who doesn’t pays it.”

Law firms have used compounding interest to generate record profits even as they claim to give clients meaningful discounts. Here’s an anonymized representation of a real firm’s increasing rates to a client between 2015 and 2018. Note the trends behind those stated rates:

As a result of this shell game of sorts, the market itself is murky. Those in legal procurement wonder, what is the ‘true’ cost? Indeed, who sets the rates? Where do these market pressures lead?

It’s the same answer year after year: costs go up and clients foot the bill.

The Future: Resetting of a Broken Market

At its basic level, a market of any kind should reset itself when the supply outnumbers the demand. The legal market has been unable to arrive at this market-clearing event due to the enormous pricing power of law firms. And law firms have that power in part because of the absence of a “source of truth” — a comprehensive dataset that gives the demand side an understanding of how law firms are price-takers in the market.

Enabling the demand side — corporate legal departments — to have verifiable, accountable data on their consumption of legal services will enable them to become active participants in the price market, and not just be passive price-takers.

This is the future we’re looking to build.

The Bodhala Difference

Bodhala is a groundbreaking legal technology platform created by lawyers to transform the half-a-trillion dollar global legal industry. Our platform refines organizational processes by empowering your legal team with deeper insights that allow you to better analyze, interpret and optimize outside counsel spend, trailblazing a new era of legal market intelligence.

With our technology and expert guidance, your legal department’s budget — that Sisyphean boulder — gets easier to understand, predict, and manage. It’s our goal that you can end this cycle for good. But it takes the power of Big Data to take on the power of status quo systems.

We’re built on data – and how we develop it, utilize it and how we analyze it for the benefit of our customers sets us apart. Our proprietary benchmarking metrics and rate review algorithms generate detailed insights into every aspect of legal spend. An intuitive dashboard puts the information you need to make more cost-effective decisions about legal service providers at your fingertips, effectively boosting efficiency and reducing your bottom line.

Bodhala’s clients understand the complexity of their work, where the market trends are, and what the next steps need to be — based on market-wide benchmarks for legal spend.

Let’s talk about the process. Bodhala takes the data you own, along with our proprietary industry data, and delivers insights into efficiency levels, law firm leverage ratios, current rates against similar firms and industry-wide averages, average matter cost, and much more.

This trove of information makes a general counsel’s team much more effective at legal spend management and getting the best outcomes from that spend. What’s more, it’s configured to help you understand precisely where your spend is and should be, compared to others in the market.

To get started, head on over to https://www.bodhala.com/demo-bodhala. We’re eager to help your legal department push that boulder.

Ready to Dive Deeper?

Sign up to get our free white paper that will help you avoid 3 of the most common billing mistakes before they happen.

Shoot us an email at [email protected], and let’s talk about how to get started.