Not all in-house lawyers handle discovery work. But the reality is that every in-house lawyer needs to take on some discovery work, no matter their area of expertise. Price discovery, that is.

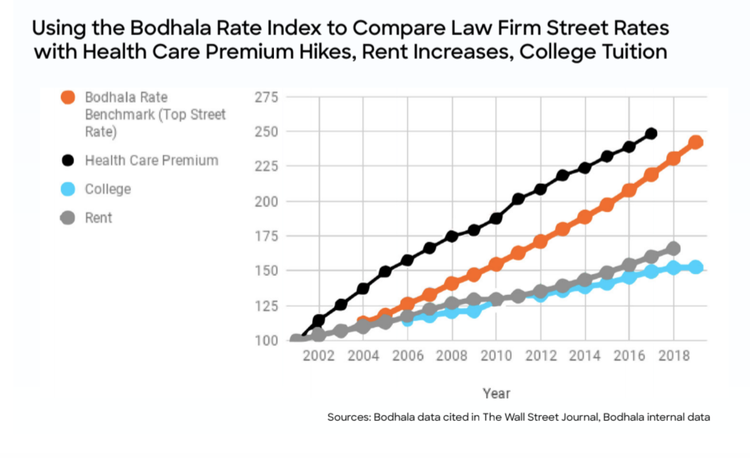

The opacity of the legal services market has led corporations – especially large ones – to be routinely overcharged by their AmLaw 200 outside counsel. Not only are corporations being overcharged, their firms’ rates are growing year-over-year at an unprecedented rate. To put it in perspective, only healthcare premiums have grown more rapidly — with legal nipping at their heels.

But why? The answer is simple: the legal services market is not an efficient economic market. In fact, you’d be hard-pressed to classify it as a functional economic market at all.

Economics 101

Governed by supply and demand, a functional market economy is squarely grounded by the ability for participants to have price discovery. This allows them to assign a value to the product or service they want to purchase – and determine if the price matches that value.

This isn’t rocket science. This concept is implicitly understood by everyone — whether they know it or not. And yet despite being a long-standing profession central to the economy, there is no true price discovery for legal services. Buyers cannot assess price in terms of value (perceived or otherwise). They cannot compare their options. Competition is restricted. It’s a mess – a mess that buyers of legal services have to wade through constantly, trying to make the best of it.

As a result, in-house teams are left at the mercy of their law firms who cite the prestige of their brand and established client relationships as justification for their ever-increasing legal fees. In-house legal teams have little choice but to build “partnerships” with outside counsel and trust that those firms are doing right by them.

How good is your “good deal”?

Law firms might insist you’re getting the best price – better than everyone else – but can they prove it? Rate discussions often leave in-house teams feeling uneasy and left wondering if they’re really getting as good of a deal as law firms claim – or if law firm antics are at play.

Law firms obsess over their realization rates. So if you’ve come to an agreement on rates and think you’re getting a good deal, chances are you’re not receiving any deal at all. Why? Because law firms will do everything in their power to manipulate the realization rate for their benefit. By jacking up the number of hours recorded to yield a higher realization rate, law firms give themselves an unwarranted raise year over year.

While it has made things complicated and costly for the buy-side, law firms have thrived on the fogginess of the legal “market”. Even when met with indisputable data and pushback from their client, a leading partner at an elite law firm claimed that they could not believe the data. An for what reason? Simply because other clients were paying the firm’s rack rates, proving that “invisible hand of the market” was at play. The murky relationship between price and value and the lack of true competition on much else other than brand and reputation has certainly padded their wallets.

But despite their hefty bank accounts, it isn’t all roses and lollipops for law firms either. The lack of price discovery in the market has its ramifications for firms, directly correlating with their constant pushback on technology and change.

If no one forces you to change, why change?

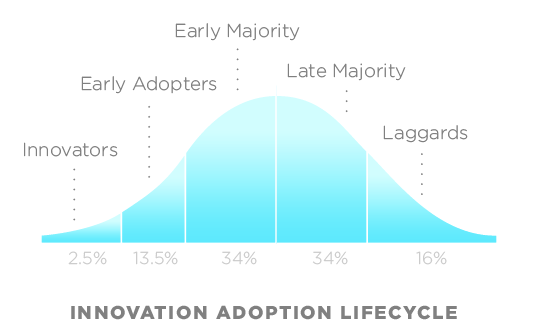

The constant influx of cash incentivizes firms to maintain the status quo, stifling competition, and cutting innovation off at the knees. To say that the legal industry is in the late majority of technology adoption would be generous – they’re laggards. This has allowed new business models to start infringing on traditional law firm turf.

Seeing an efficiency gap and firms’ unwillingness to innovate, ALSPs (Alternative Legal Services Providers) have not only cropped up but gained mainstream acceptance. Tasks – and some types of matters – that used to be billable hours for law firms are now being allocated to faster, more cost-efficient resources.

Pressure for accountability

The gravity of market inefficiency has been heightened recently due to the global economic crisis caused by Covid-19. Historically, top tier firms have continued to enjoy constant and sometimes accelerated growth during economic downturns. But with balance sheets under more scrutiny than ever, legal spend is starting to be examined in earnest.

GCs and CFOs across industries can no longer afford to tolerate idle price-taker behavior.

C-suite mandates to cut costs are straining internal relationships between legal and finance, forcing legal departments to find opportunities for potential savings in each line item of their budgets. Law firm relationships are no exception.

It’s fair to say that the legal services market is broken, hurting on both the buy- and sell-side. Corporate legal departments are saddled with year over year rate hikes well above inflation, without the tools they need to understand the value they’re getting. Work that used to constitute billable hours for law firms is being siphoned off to more economical service providers. Overpriced and stagnant. But does it have to be that way?

Data: The key to a level playing-field

The simple answer is, no. There’s a treasure chest just around the corner — full of 0’s and 1’s. No, it’s not a special edition of Lucky Charms. It’s data.

Data has the power to turn in-house teams from price-takers to price-makers. Data puts them in the driver’s seat, giving them the transparency they need to understand the value they’re getting from their firms and optimize from there – be it with rates, efficiency, or stewardship.

Based on Bodhala platform analytics, our legal experts predict that in-house teams have the opportunity to realize between 15-30% in savings by leveraging their own data. Data is the key to unlocking competitive, market-based rates. But to truly understand if those rates are delivering the value necessary to justify the price, companies need evidence. Data is that evidence.

The legal services market is one in which nearly all buyers underestimate their leverage. In-house teams have the ability to drive real change and break through the status quo on everything from fair market pricing to increasing diversity in the industry. The buy-side is now in a position to use data to incentivize accountability and innovation from the sell-side. If your firms don’t fight for your business by pushing themselves to change, then they’re not a critical partner to your business.

The reluctance to provide transparency and adopt technology has created a distinct advantage for the sell-side. Continuing down that path puts industry incumbents in a precarious position.

Disruption is already here for the legal services industry. We need a functional, transparent market for legal services. Advocating for transparency and the active use of data will be the difference between those who succeed in riding the wave of change, and those who drown fighting the tide.

The question is this: Will you embrace data and transparency before it’s too late?

—

Get in touch with our team of legal billing and data experts to find out how Bodhala can transform your legal department.