Salvaging a business during bankruptcy comes with a hefty law firm price tag.

Surviving bankruptcy is a delicate balancing act.

As businesses scramble to preserve assets and employees, they must retain law firms that can guide them through the unknown.

In some of the largest bankruptcy filings within recent years, law firms have received massive payouts while significant workforce reductions occurred.

More often than not, employees are laid off without severance even though company executives, boards, and bankruptcy judges allow law firms to charge hugely excessive fees throughout the bankruptcy process.

Company executives and board members have suffered severe reputational damage by not effectively managing the needs of their distressed businesses and employees.

Although layoffs are often inevitable and lawyers play a critical role in bankruptcy filings, Bodhala data shows that law firms have charged exorbitant rates that exceed those of other mission-critical legal services.

History will repeat itself during COVID as a potential record number of bankruptcies loom.

Enter Bodhala.

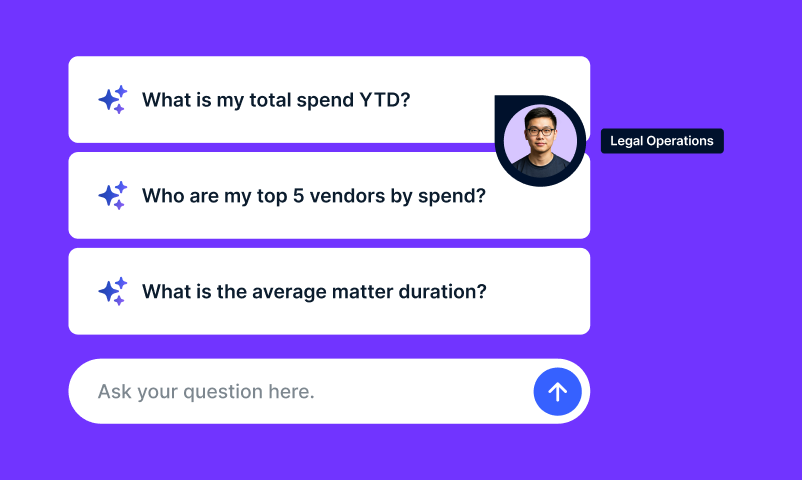

There is power in your data to control spiraling legal fees.

Bodhala’s Hercules database – consisting of 32,000+ law firm profiles, 5 million matters, and over 500,000 timekeepers – helps you ensure you hire the right lawyer at the right law firm at the right price.

Historically, rates for bankruptcy and restructuring work are undiscounted street rates. As the Trustee Program states, the rates must be comparable to similar work, but our data shows that rates for similar work are significantly lower than those currently being approved by the Trustee Program.

The market is significantly overcompensating law firms for bankruptcy and restructuring work.

Throughout some of the largest bankruptcy cases over the past several years, employees suffered immensely while law firms padded their wallets. Let’s review how this played out at Lehman Brothers and Toys “R” Us.

Lehman Brothers

The investment bank’s collapse came in September of 2008, catalyzing the financial crisis that rocked the U.S. economy to its core.

More than 30 law firms were retained throughout the bankruptcy and liquidation process, making Lehman Brothers the most expensive bankruptcy in history. Firms accrued over $2 billion in legal fees.

Lead counsel for the investment bank, Weil, Gotshal & Manges, racked up over $484 million with lawyers billing up to $1,000 per hour.

So what happened to the employees?

The company’s entire 25,000-person workforce was laid off.

Employees were angry, distraught, and left to pack up their desks while bankruptcy lawyers began their feeding frenzies.

Lehman’s CEO, Richard Fuld, suffered severe reputational damage as a result of the bankruptcy. Some referred to him as one of the worst CEOs of all time due to his negligence in protecting the company from the inevitable doom when he had the chance.

Toys “R” Us

The beloved toy store chain succumbed to bankruptcy in 2017.

As a result, the company received a hefty legal bill as their lead counsel, Kirkland & Ellis, took home $56 million.

Judge Keith Phillips reviewed and approved the firm’s fee application which listed the top two earners as raking in over $3 million dollars, billing hourly rates between $995 and $1,480.

105 partners and 131 associates at Kirkland & Ellis worked on the bankruptcy case with seven partners and associates billing over one million dollars EACH in fees.

What did the Toys “R” Us employees take home?

The employees who missed out on Thanksgiving dinners to accommodate Black Friday shoppers, those who sacrificed family gatherings to cover shifts, and spent their birthdays working instead of celebrating…they must have received something, right?

Think again.

The entire 33,000-person workforce was laid off without severance pay.

Though the company initially promised employees severance, they quickly rescinded the offer as the retailer continued its downward spiral.

The Toys “R” Us bankruptcy was an outrage and led to the public shaming of the executives, board members, and bankruptcy judges that oversaw the filing.

The list of cases in which employees suffered while top law firm partners walked away with huge sums of money goes on. It will only continue to grow throughout the COVID crisis if we do not hold law firms accountable.

It is now more urgent than ever to find efficiencies in your company’s legal spend.

Bodhala is your partner for making this happen.

Our platform helps you ensure that you are balancing precious dollars between employee stakeholders and law partners.

Real transparency, real accountability, real control – that’s what we’re all about.