Managing outside counsel can sometimes feel like herding cats. There, we said it. Phew. Glad that one’s out in the open.

Maybe you believe one firm is overcharging you on rates, while another is going to town on block billing, and another is staffing partners on tasks a first-year should definitely be doing. You know these things are happening, but do you have hard evidence? Figuring out how to drive meaningful change with your firms can be tough — even simply knowing where to begin is a challenge.

Smart legal ops teams use, you guessed it, data (!) to manage their outside counsel — and their first stop on the road to crushing department priorities is quarterly business reviews, better known as QBRs.

QBR meetings give them a platform to discuss performance and rate trends, successes, as well as opportunities for improvement. While it’s of course critical to meet about the meat of your matters, setting aside time to review your business relationship sets you up for success both with your firms, as well as with your internal stakeholders (budget season is coming, amirite?).

So, what can you expect to get out of a well-prepared QBR? Here are five ways innovative legal ops teams are using their QBRs:

1. Rate Review

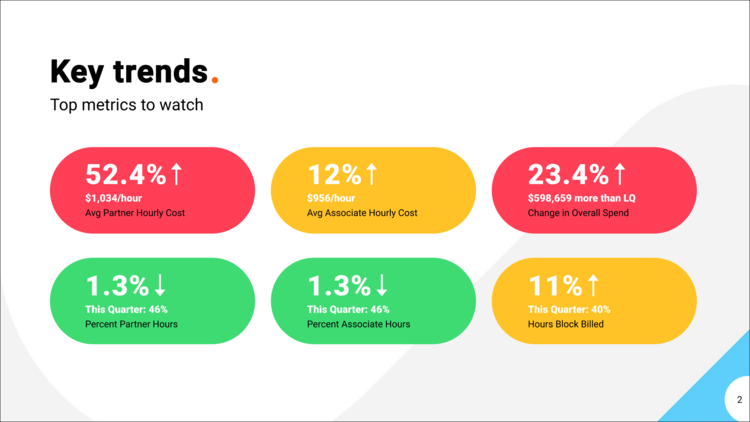

Rate review shouldn’t be a once-a-year task — especially with the sly pricing tricks law firms are known to deploy to rack up their billings. Regular analysis of your law firm’s activity and rates by timekeeper level can ensure that you don’t overpay unnecessarily.

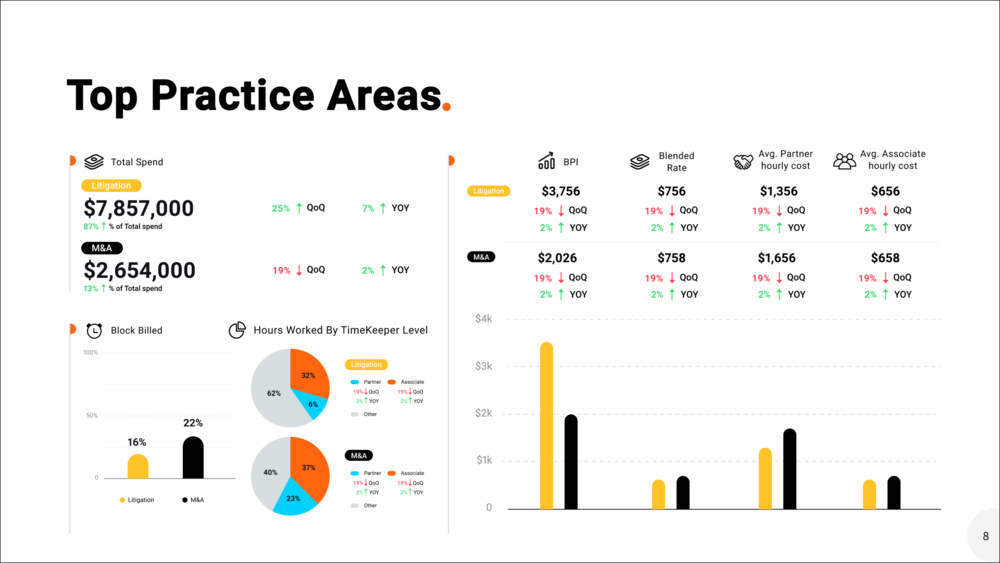

By surfacing critical data across practice areas and analyzing rates on a quarterly basis, QBRs unearth important trends that can eliminate increases — sometimes even leading to reductions or discounts. QBRs provide the venue to negotiate fair market rates and manage your discounts, regardless of if they’re practice area-specific, volume-related, or otherwise.

With clear and objective insights under your belt, you can easily open up a data-driven dialogue with your law firms to address any concerns, then start — and win — rate negotiations.

2. Panel Review

Without data on your side, value can be in the eye of the beholder. Consider what you’re paying your firms. Now think about what they’ve done for you in the past year. Are they congruent? Did you truly get what you paid for? How did they stack up against other firms you use in the same practice areas?

We’re guessing you might be feeling a slight wave of regret washing over you. Shake that right off. QBRs are a great fix.

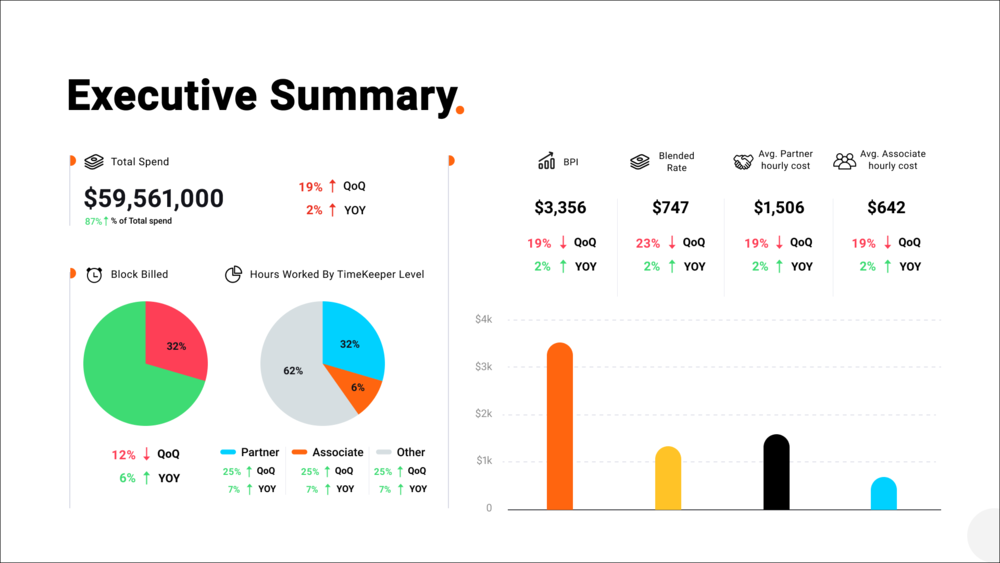

By taking key metrics into account like total outside counsel spend, average hours per matter, and percentage of time block billed, QBRs surface insights on the value your firms deliver and opportunities for value to be maximized. By lining up those metrics against other firms working across the same practice areas — or the same panel — you can begin to see trends that may impact how you allocated work in the future, or even prompt you to change the panel composition.

3. Performance Management

If you’re like most corporate legal departments we work with, you’re probably paying a partner for something a first-year associate should be doing. We emphasize “probably” because it’s nearly ubiquitous — Bodhala sees this behavior across nearly every firm. We like to call it “partner hoarding”. Some firms are more egregious than others, but it truly impacts your budget when it’s happening on a regular basis.

With cost-cutting a constant priority for corporate legal departments, QBRs are a great way to easily help correct this problem.

Digging into activity across your practice areas can highlight key metrics, such as average partner hours, average associate hours, and your partner to associate ratio. By clearly highlighting key trends, such as partners logging significant hours on routine work or firms exceeding their associate ratio, you can determine where exactly you need to course-correct and rein in the unnecessary dollars being spent.

4. Reporting to Internal Stakeholders

Many legal departments are feeling the heat from the C-suite to cut costs and run their departments more like a ‘business’. We all know that reporting to internal stakeholders can become a real pain in the…you know what. For many corporate legal departments, reporting capabilities are stuck in the 1990s, leaving them to conduct manual analysis and pore over spreadsheets.

QBRs place all the data that in-house teams need at their fingertips — often in a format that they can pass along to internal stakeholders without any edits or changes.

Your QBRs should deliver in-depth analysis and actionable recommendations – which can be tough without appropriate software or a robust legal ops team. Setting yourself up with a top-tier legal analytics platform (cough, cough…Bodhala…!) can be the difference between easy-breezy and hours of work. That said, the work is worth the impact and the ability to pass a nice, neat package to the finance department.

5. Gut-Checking Large Matters

Law firms often claim forecasting a budget for upcoming matters is an impossible feat, citing a lack of precedent or the “unique nature” of every matter. Sure, not every matter is cookie-cutter, but there are absolutely trends. Just like you can dig into historical legal precedent, you can also dig into historical cost precedent.

A great QBR will drill into top matters from the past quarter and highlight key metrics that you should watch in the future. Even without a sophisticated legal billing analytics engine, keeping a record of such historical analysis can be incredibly helpful in projecting costs — everything from setting expectations around hours and tasks to rates.

Having this information on hand helps in-house teams gut-check future matters of similar volume and complexity. Not only that, but great QBRs should offer the opportunity to make the appropriate changes needed to rein in extraneous expenses and keep your budget in check, such as revisiting how work is allocated, renegotiating your practice area discount, or updating your outside counsel guidelines to eliminate unreasonable billings.

Sophisticated Reporting + White Glove Service = Better Business Outcomes

Data-driven conversations are foundational to the success of not only your law firm relationships but your entire legal department.

QBRs are a great opportunity for in-house teams to get their feet wet in legal data analytics and see how transparency — and even just incremental change – can drastically reduce your legal spend and eliminate budget overages. Transparency itself can often be a major catalyst. Ever notice that when someone knows you’re watching, they start acting differently? QBRs can produce that same effect, known as the Sentinel Effect — let them know big brother is in the building, and they’ll clean up their act. We wrote a whole piece about it — check it out.

If you’re resource-constrained or you don’t have a legal ops team, don’t worry. We got you. You don’t have to be a data scientist for QBRs to transform your legal department — that’s our job :).

Ready to learn more? Get in touch with our team to discuss our QBR Program and the savings that await!