Raj Goyle, CEO of Bodhala, and Darren Guy, Chief Operating Officer of Global Legal, Compliance and Regulatory Affairs at AIG, sat down together – virtually, of course – to discuss his data journey at AIG and how Bodhala’s technology has empowered him to optimize spend and business operations.

Darren is the epitome of an innovator in the legal operations and spend management space, and we’re thrilled to be able to share his insights with you.

RG: Darren, thanks for taking the time to speak with me today. I’m excited to delve into the legal operations and data transformation you’ve led at AIG. Now, you’ve mentioned to me that when you arrived at AIG, the legal billing data was quite decentralized and bespoke? Is there a value that Bodhala now brings by centralizing and standardizing your data?

DG: Since arriving at AIG in early 2018, my team and I have worked diligently to revamp the foundations of our legal expense data analytics program while rebalancing our overall technology portfolio, enabling quicker management decisions and continued excellent legal outcomes, while bringing down total overall enterprise cost. We have combined internal “old school” finance techniques such as standard financial reporting and analysis discipline with more modern (and increasingly cheaper) SaaS-based external vendor data visualization applications (such as from your company), which allows our department to be more nimble and cost-effective. Bodhala has played an important role in these recent transformational efforts, as we continue to improve legal expense efficiency and performance through improved data visualization efforts.

We had been creating reports before Bodhala, but due to somewhat decentralized operational processes that created inconsistent data elements, it was extremely difficult (and time consuming) to make sense of our data in a timely fashion. Legal costs, particularly legal claims litigation expenses, play an integral role in the bottom line of any insurance company. It’s imperative our leaders have the best quality data as soon as reasonably possible in order to make proactive case management decisions. If you’re unable to quickly identify meaningful data trends and anomalies in your business lines, that can translate into significant missed opportunities for any company.

Bodhala’s anomaly detection and data visualization capabilities help me bring a bunch of disparate data sources together to make better sense of our management information. By cleansing and restructuring our data, Bodhala has allowed us to reset and improve our reporting and analysis deliverables for my corporate legal and claims colleagues, fueling more consistent and proactive management decisions.

RG: How do you approach change management in such a large organization that might be set in its ways?

DG: I think change management has been the hardest part of my job — much more difficult than procuring different technology solutions or creating new policies. But that’s not exclusive to AIG by any means. Insurance is a very established industry with norms that can be hard to break.

As we seek to improve data analytics capabilities at such a large organization with a long history of doing things a certain way, we are increasingly mindful of the importance of effective overall operational procedures and strong data governance policy. Data visualization programs are more successful when working in tandem with consistent procedures that produce common data elements. If you don’t have effective operational “golden rules” that govern your key data elements, any corporate technology application will struggle to be successful (i.e., the often-used analogy about garbage in, garbage out).

RG: What has been your primary tactic with your team in order to build an effective legal operations function?

Since my arrival at the beginning of 2018, I’ve spent a significant amount of time promoting cross-training and collaboration opportunities within our AIG Legal Operations team so everyone understands all of the important functions of legal operations as a business; not only how they can improve the efficiency and effectiveness of our AIG Legal Compliance, Regulatory and Government Affairs/Public Policy team, but also how our hard work contributes to solving some complex problems for AIG in a way that minimizes risk while improving financial performance. As I’ve said many times to our employees internally, we only have one stock price.

RG: The word “relationship” has been overused to stand as a proxy for economic and business value. The question we’re asked all the time is – how does the use of data in your industry affect the “relationship” with a law firm? How do you handle that?

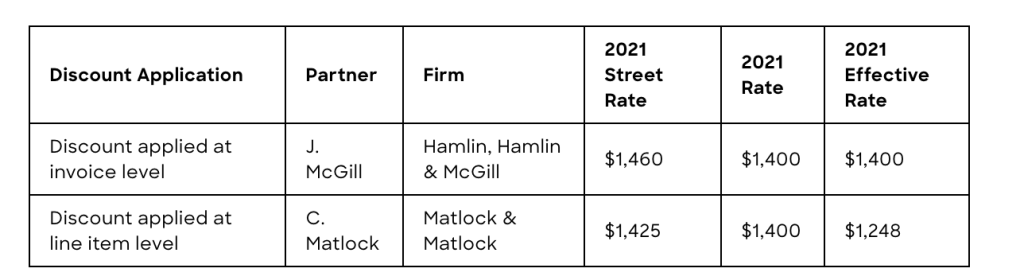

DG: Meaningful data visualization techniques (i.e., presenting management information in a clean and easy to digest fashion) is key to having real and robust periodic conversations with your law firm strategic partners. Note I said strategic partner, not vendor, as we are not buying pencils here; rather, we are cultivating significant enterprise relationships and so a variety of both quantitative and qualitative metrics can support meaningful discussions about what is working well with a particular firm, or perhaps identifying areas where adjustments may be needed. It is important to conduct a healthy dialogue and share an honest assessment of the overall value a firm brings to your company, and Bodhala helps us do that by presenting information from disparate data sets in a clean and professional manner. Bodhala’s Firm Report Cards provide a centralized snapshot of our top matters, top billing rates, and discounts, partner/associate staffing ratios, plus a host of other metrics/KPIs as defined by us.

We get more out of these meetings in terms of real two-way constructive feedback when we can demonstrate command of the KPIs/metrics via effective data visualization approaches, which allows us to pivot to more constructive and impactful conversations about effective case management strategies and outcome-based value pricing techniques. If you don’t have an accurate understanding of “time value of money” economic concepts for your legal matter portfolio, it is hard to drive real efficiencies in your organization through pricing modernization.

RG: We run into potential customers who think they don’t need Bodhala because they have an eBilling system in place. AIG uses both – can you explain how your eBiller and Bodhala work together?

DG: EBilling applications are important and necessary, but in my opinion, are increasingly “table stakes” in an organization, as they are still just a collection of flat files heavily dependent on law firm billing accuracy and consistency. Bodhala can be a more dynamic addition to your technology portfolio, with its proprietary Hercules engine cleansing eBilling or other key department data, acting as a reporting “turbocharger” of sorts for an organization, providing usable analytics required to run a data-driven legal business. The ability to cleanse and restructure information can be critical for a larger organization still in the journey of cleaning up decentralized matter management practices. One other big advantage is the ability to enrich e-standard eBilling data with meta/contextual data from other sources and have it analyzed in one place. It gets us closer to truly understanding the “why” instead of the “what just happened”, which can lead to better intelligence and ultimately better pricing.

Also, as the costs of technology applications decrease significantly due to SaaS-solutions in the Cloud, companies can now rebalance their total technology portfolios in a way where they can spend less on their technology portfolio overall while adding more advanced (but complementary) anomaly-detection data visualization products such as Bodhala to their eBilling applications, while also separately investing in more workflow tools for Legal attorneys and Compliance professionals. In short, as costs have come down, we’ve been able to provide more smart technology solutions to our customers. I expect peer companies of our size will ultimately take advantage of both eBilling and advanced analytics platforms in the future.

RG: Could you manage your department at scale without Bodhala?

DG: Of course. We could get the same metrics and measures without Bodhala, but it would take us more time and would require more resources. We can scale much more quickly with Bodhala. We help manage a significant amount of legal spend in our portfolio across many insurance business lines, so for me, managing every available expense lever appropriately is like a giant Rubik’s Cube, and it takes every forward-thinking tool in our toolbox – and that’s why we ultimately decided to add Bodhala to our product mix. Our ultimate goal is to help our attorneys manage our legal matters in the most efficient and effective way possible, and Bodhala helps me and my team do that by augmenting our data analytics program in a way that appropriately balances legal risk with economic discipline. Our legal operations mission is to always find the best combination of “right firm, right price”, leading to the optimal outcome for AIG and its insureds.

RG: If you found someone who is beginning their legal operations journey, what advice would you share with them?

DG: First, surround yourself with people who are energetic, intelligent and inquisitive, with expertise in a variety of areas (e.g., finance, operations, IT, project management, information management, administration) who can help you manage the business of law.

Next, create an effective working partnership between legal and finance, as soon as you can. I think a lot of companies overlook that portion of the legal operations job. And don’t underestimate the role that proactive communication and expense transparency play with your internal corporate and business partners, and how that translates into improved collaboration and trust throughout your organization. No shocker here, but business folks are full of numbers people, and they simply want to be included in what’s going on. A good legal operations liaison should be able to effectively communicate how your company is proactively balancing both external and internal resources and expense ratios to manage one of the biggest and most volatile expense lines at the company. Communicating the value of the legal team using clear and concise data is critical to maintaining credibility and enhancing the legal department’s reputation within an organization.

But regardless of your industry, don’t shy away from advances being made in data sciences and information management. Because at the end of the day, isn’t the entire goal of Legal Operations to present information to management in a way that helps efficiently solve complex problems? Use it to drive efficiency, to increase the speed of management decisions, and ultimately to demonstrate to your organization that you’re getting the most value from every dollar that is spent on behalf of legal services.

—

Get in touch with our team of legal billing and data experts to find out how Bodhala can transform your legal department.