Legal spend surprises rarely announce themselves. They accumulate quietly, compounding over months before anyone notices. By the time finance asks questions, the spiral is already underway.

Most legal departments have eBilling tools. They track invoices, enforce guidelines, and generate reports. Yet spend still climbs unexpectedly. Quarter-end surprises still happen. Budget conversations still feel reactive.

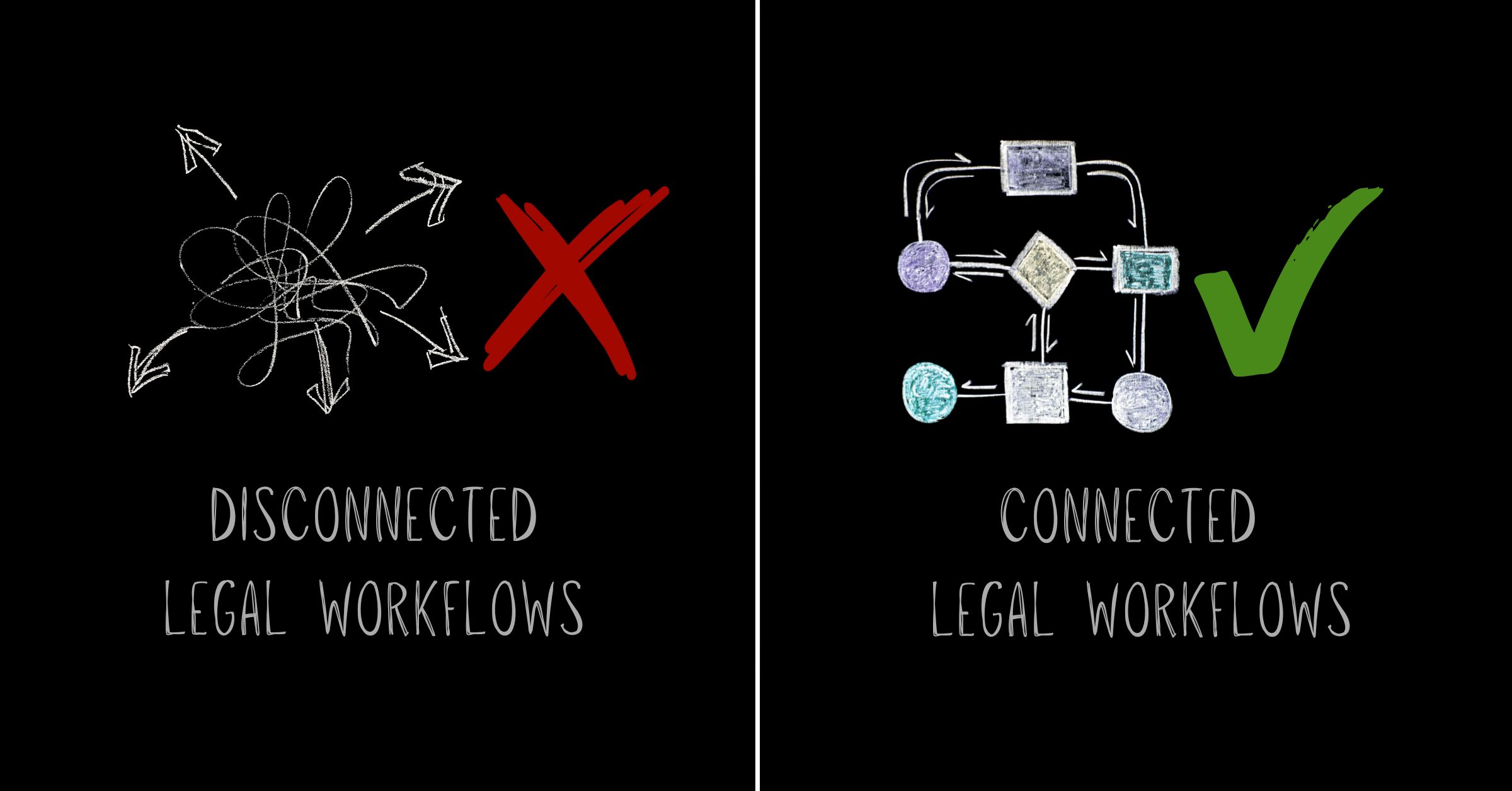

The problem isn’t a lack of technology. The problem is where visibility breaks down between intake and invoice approval.

eBilling captures what already happened

Legal eBilling systems excel at managing invoices after work is done. They validate rates, flag guideline violations and route approvals. But they can’t change what already occurred upstream.

When an invoice arrives for review, the work is complete. The hours are billed. The decisions are made. At that point, legal operations teams can only accept, adjust or reject line items. They can’t reshape the scope or reallocate resources that were already consumed weeks earlier.

This creates a fundamental timing problem. The data arrives too late to influence the behaviors driving cost. Teams spend time reviewing individual invoices rather than understanding patterns across matters, firms and practice areas before they repeat.

Early signals get missed during intake

Legal spend surprises begin long before invoices arrive. They start when matters open without clear scope, when rate exceptions become routine through informal approvals or when intake volume increases without visibility into downstream complexity.

These early signals are often dismissed as operational noise. Teams focus on keeping work moving and supporting business needs. Intake stays intentionally high-level to avoid slowing requests. Matter details remain incomplete because gathering them feels like friction.

The result is that cost drivers go unnoticed during the one moment when intervention could still make a difference. By the time the work reaches invoice review, the opportunity to adjust course has passed.

Adding more review layers doesn’t create insight

When spend pressure becomes visible, the instinct is to add control. Teams implement additional invoice review steps, expand approval layers and increase oversight.

This creates the appearance of rigor without improving visibility. Legal operations workloads increase as more time goes to line-item reviews. Yet savings plateau because the effort happens after spend has already occurred.

Patterns repeat across matters and firms, but they’re discovered manually and too late to influence decisions. The ELM system functions as a repository rather than a source of actionable intelligence. Budget conversations center on totals instead of the behaviors driving them.

Control feels present because activity is high. But most of that effort addresses symptoms rather than causes.

The gap between matter data and invoice data

Legal departments often manage matters in one system and review invoices in another. Even when both live in the same platform, the connection between them is weak.

Matter forecasts are created at intake but rarely compared to actual outcomes in a way that surfaces behavioral patterns. Invoice data is analyzed by firm or timekeeper but not consistently mapped back to matter type or complexity. Data fields remain incomplete or inconsistently used because no one connects them to spend decisions downstream.

This fragmentation means that insights about cost drivers exist in the data but never surface in time to shape decisions. Teams can see what happened last quarter but can’t predict what will happen next month.

AI can surface patterns, but only if it’s connected to the right workflows

Some legal teams are adopting AI-native systems to identify spending patterns earlier. These tools can compare invoice data across similar matters, flag repeat billing behaviors tied to specific firms or matter types and surface differences between forecasts and actual outcomes.

But AI alone doesn’t solve the visibility problem. If the system only analyzes invoices after they arrive, the timing issue remains. The value comes when AI connects intake, matters and invoices into a single operational view.

When legal operations can see cost drivers before work begins, when they can track behavior patterns rather than individual line items and when they treat spend insight as an operational capability rather than a quarterly exercise, the signals start arriving early enough to act.

What changes when visibility arrives earlier

Legal operations teams that recognize the spend spiral early tend to intervene sooner. They can clarify scope before work accelerates, address counsel behavior before it becomes habitual and ground forecasts in reality rather than optimism.

This doesn’t require massive process overhauls. It requires connecting the data that already exists across intake, matters and invoicing so that signals surface when they still matter.

Teams that achieve this shift focus on:

- Understanding which matter types and firms consistently exceed forecasts

- Identifying behaviors that contribute most to variance between estimated and actual spend

- Spotting patterns that appear across multiple matters rather than treating each as an isolated case

- Recognizing moments when insight arrived too late to influence upstream decisions

The goal isn’t perfect prediction. The goal is enough early awareness to make better decisions about scope, staffing and firm selection before costs accumulate.

The real cost of late visibility

When spend signals arrive only during invoice review, legal operations becomes reactive. Teams defend budgets instead of shaping them. They explain overruns instead of preventing them. They add control mechanisms that create work without creating insight.

Finance loses confidence in legal’s ability to forecast accurately. Leadership questions whether spending aligns with business priorities. Legal operations teams feel the pressure but lack the tools to address root causes.

The irony is that most legal departments already have eBilling systems generating the data. The challenge is making that data visible early enough to change outcomes.

Where to look for earlier signals

If your legal department has an eBilling system but still faces spend surprises, the breakdown likely happens in one of these areas:

- Outside counsel rates increase through one-off exceptions that slowly become routine

- Matter scoping stays intentionally high-level to avoid slowing intake

- Intake volume grows without clarity on complexity or downstream costs

- Invoice review workloads increase while savings plateau

- Budget conversations center on totals instead of the behaviors driving them

- Top spend drivers by matter type remain unclear

- Patterns that appear across multiple matters go unnoticed until quarter-end

These signals don’t announce themselves. They accumulate quietly in the gap between intake and invoice approval. Legal operations teams that can see them earlier are better positioned to act before the spiral accelerates.

Moving from legal spend surprises to prevention

eBilling tools are necessary but not sufficient. They provide the infrastructure for spend management, but they don’t automatically deliver the visibility needed to prevent surprises.

That visibility comes from connecting intake, matters and invoices into a single operational view. From focusing on behavior patterns rather than individual line items. From treating spend insight as something that informs decisions in real time, not something that explains variances after the fact.

Legal departments don’t need to abandon their eBilling systems. They need to close the gap between when cost drivers emerge and when those signals become visible. The sooner teams can see the spiral forming, the sooner they can intervene.

Understanding the legal spend spiral is the first step. Seeing it early enough to act is what changes outcomes.

Ready to stop explaining overruns and start catching them before they accelerate?

If your eBilling system is doing everything it’s supposed to and spend surprises are still showing up anyway, you’re not missing discipline. You’re missing signal.

The Legal Spend Spiral guide breaks down where costs quietly compound between intake and invoice approval, what early warning signs most teams overlook, and how to shift from after-the-fact invoice control to real spend prevention.

Download the guide to spot the spiral earlier, intervene faster, and regain control before quarter-end forces the conversation.