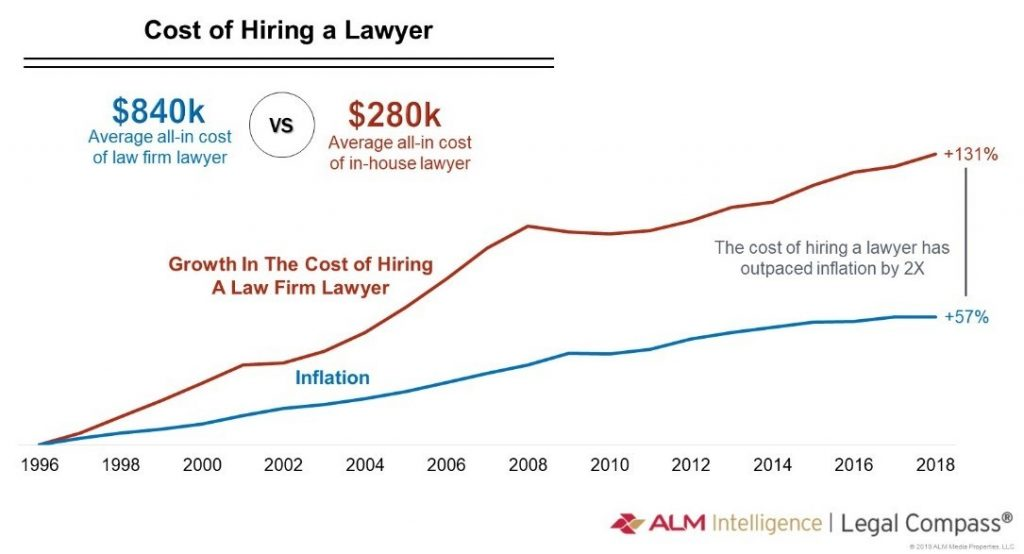

It’s your not-so-favorite time of year again: it’s rate card season! Whether you are in the legal department or procurement, your frustration level is probably at an all-time high as you manually try to track your legal rates from years prior.

The truth of the matter is legal department employees poring over data in countless spreadsheets are not going to be able to establish the baseline needed to give the GC a fighting edge in negotiations. There are too many variables for human eyes to process. But there are steps you can take set your team up for success.

As your team is inundated with rate cards from your outside firms for their new rate cards for next year, there’s a lot of jargon and confusing variables to consider, so we’d like to set forward some guidelines — a cheat sheet — to help you understand the steps ahead.

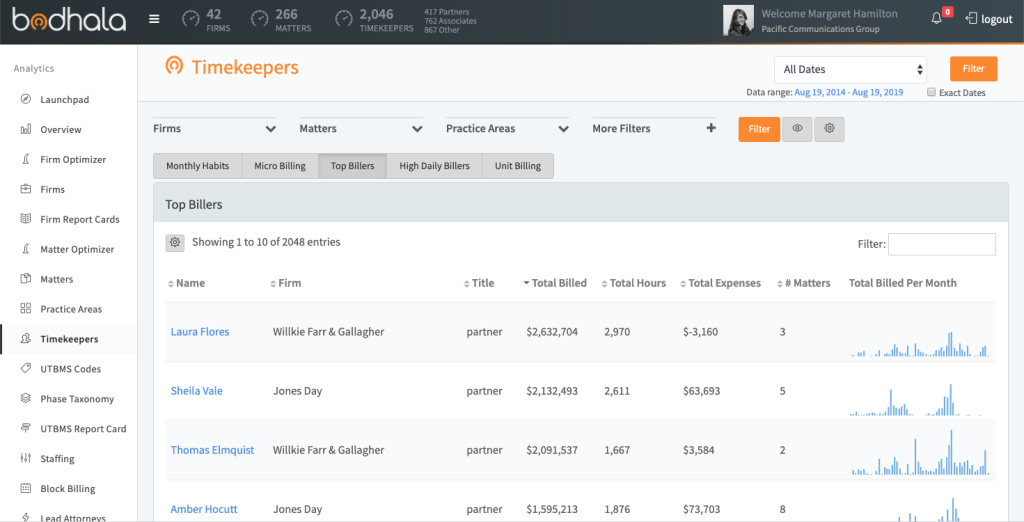

First, let’s lay out the basic nature of law firm economics: your work over the course of a year can be done by dozens of timekeepers at any one firm and hundreds or thousands across your portfolio. Each of these partners, associates, and paralegals has a different rate.

While you may look at a blended rate to simplify things, these individual rates matter. Even at a more general rate card level, a firm typically has ten to fifteen different rates for the associate and counsel level and ten to twelve different partner rates, depending on firm-specific seniority.

Misunderstanding this rate structure can make it difficult to understand the true rate you’re paying for the work being done from the start.

On top of that, there are several levels of rates that can change depending on a number of factors, including your history with the firm, the practice areas implicated by a matter, and the internal dates of matriculation for timekeepers at firms. It creates a laddering of rates in a sense. We call it the Hidden Staircase of law firm rates.

The Importance of Data in this Process

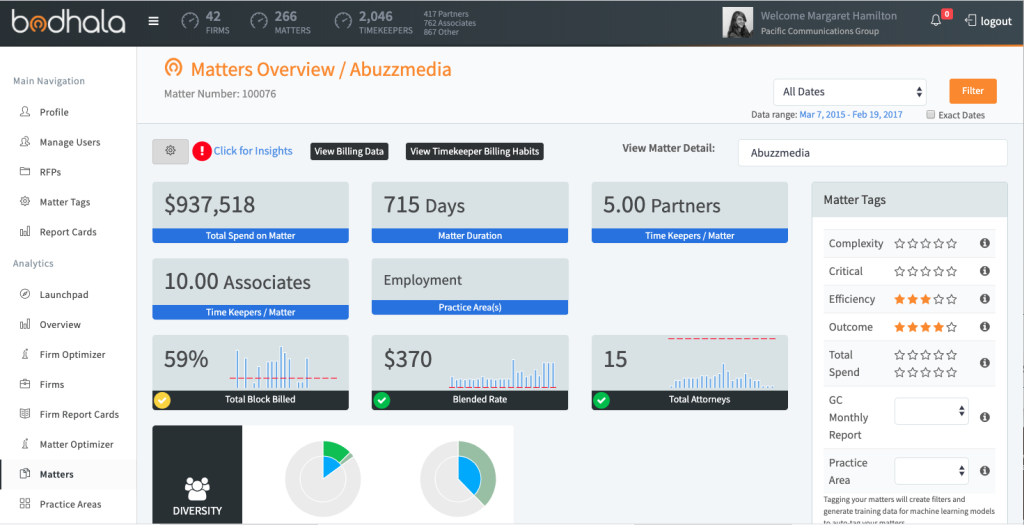

It’s hard to overstate how tricky the process of negotiating rates can be. To help you understand where this negotiation starts, think back to how your legal department’s spend has gone throughout the year prior. In every matter, you receive hundreds, if not thousands, of billing line items.

You can look at data points to get a sense of the direction of your spend. While it’s tempting to think that poring through spreadsheets or basic eBilling platforms can uncover a law firm’s tricks, they simply can’t. While these platforms give you, at most, a flat snapshot into your legal billing, there’s a richness, context, and breadth that’s missing. And while legal departments can try and triage in search of a solution for understanding the process, it’s important and far more challenging to dig deeper and get a broader view across your spend.

Our Approach Versus the Status Quo

At Bodhala, the leading tech platform enabling corporate legal teams to analyze and optimize their spend, we unlock the power of your data to help you get a firm grasp on rate negotiations. Most legal departments keep track of billing through spreadsheets and online forms systems, and we know that getting a handle on next year’s rates requires such a level of detail and finesse that it’s nearly impossible for companies to do on their own.

Part of our power is our unique ability to analyze and explain your spend through data ingestion. Paired with Bodhala’s world-class machine learning data analytics platform, our robust legal billing rate negotiation process helps you get the most granular view on your spend, regardless of matter type or complexity.

Our Proprietary Rate Card RFP Platform Enables Our Customers To:

- Simulate future spend expectations against past work

- Understand the complicated modern law firm economics behind associate and partner matriculation, which adds another dimension of complexity

- Distinguish discounts at the line-item level versus invoice level

- Understand how outside counsel has billed for work done

- Get real, data-backed predictability to manage spend moving forward into next year

In the Meantime

We want to be a helpful guide on this Hidden Staircase toward next year’s legal rates as it exists today. It’s our goal to help give some clarity to these steps and make sure all sides are accountable for their claims and make good on their agreements. This process might seem frustrating, but there are moves you can make to ensure your legal department gets the most equitable and most valuable rate agreement for your money.

We lay out what all these steps mean below, but suffice it to say, some of these rate discussions can get “in the weeds” rather quickly.

Starting the Rate Card Negotiation

We’ve outlined some strategies to use with your law firms as you begin the process of your next yearly rate negotiation. The main focus should be on bringing every step on the staircase to the surface, set terms, and agree to a negotiated understanding of those terms.

Step 1) Rack Rates: Set the Baseline

First, you should ask your counsel to memorialize the currently-in-force yearly actual billing rates to your company, and what their next year’s Standard Rates (“rack rates,” “street rates”) will be. Tip: You should include a statement that “no rate increases will be accepted until there is explicit approval by the client.”

Step 2) Relationship Discounts

Maybe you’ve heard your legal department gets a discount off rack because of a long-term relationship. It’s time to memorialize that understanding: for next year, your outside counsel should provide both the proposed billing rates for your company AND the published rates in their rate card. This enables you to know the current prevailing discount percentage they are providing off of published rates at present, and for what they are proposing for the coming year.

Like what you’re seeing?

Download our free white paper report to learn steps 3-7 on how to understand, predict, and act on every step of the rate card negotiation process.

THE HIDDEN STEPS WE EXPLAIN:

- Work-Type Discounts

- Net Effective Rate for Next Year

- Volume Discounts

- Write-Offs

- Your Matter-Based Net Effective Rates

Download The Full Article

Shoot us an email at [email protected], and let’s talk about how to get started.