While companies face a financial collapse, bankruptcy & restructuring partners prepare for big paydays.

Article Highlights

- The coronavirus pandemic has a number of large retailers facing bankruptcy and restructuring.

- Law firms will reap the benefits of other companies’ financial collapse once more if they are not held accountable.

- Bodhala can serve as a resource for companies to ensure they hire the right lawyer at the right law firm at the right price.

Floor after floor of designer brands. Elaborate holiday displays emitting a sense of joy and a tinge of magic. Rushes of crowds fulfilling their Black Friday shopping lists. These happy memories that department stores once created have now been replaced by nail biting calls with creditors and endless meetings with Big Law firms as they prepare bankruptcy filings for numerous retail companies and their boards.

The coronavirus pandemic has vaporized any aspect of normalcy we once knew and continues to decimate our economy, taking out businesses big and small.

With shelter-in-place orders in effect for nearly two months now, non-essential businesses are feeling the hurt as some of the biggest names in retail fall victim to bankruptcy.

The current economic distress is leaving the likes of Neiman Marcus, Macy’s, and Nordstrom facing bankruptcy while JC Penney is now in advanced loan talks with existing lenders.

Penney’s loan package could total between $800 million to one billion with bankruptcy filings potentially taking place within the next few weeks.

The rapid financial downturn has left department store chains with only a few choices:

- Restructure debt directly with creditors;

- Restructure with court assistance;

- Liquidate entirely.

Sadly, any of these options come with law firm sticker shock.

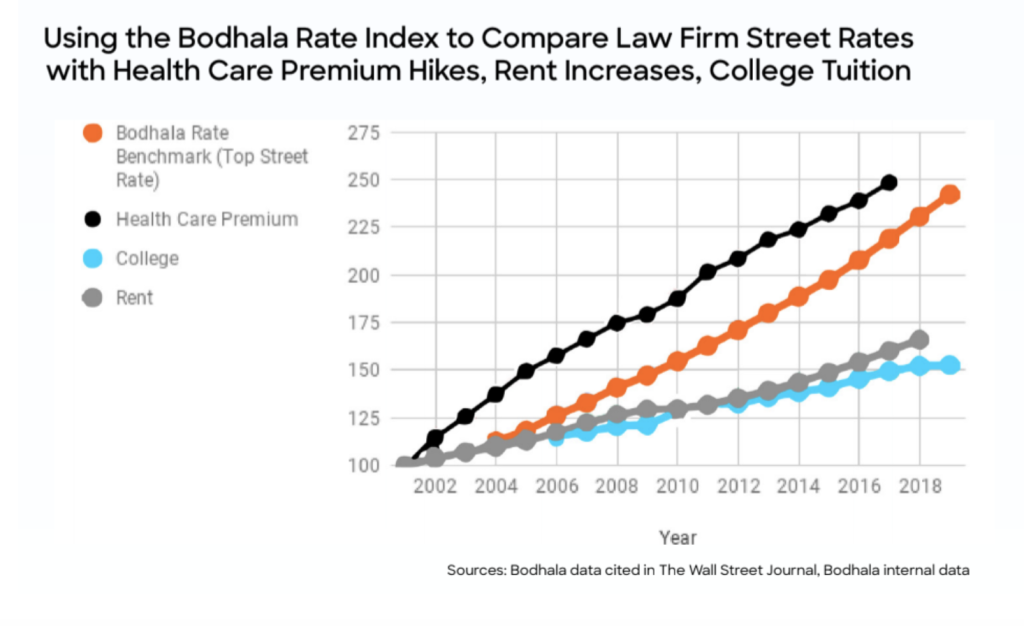

Sales and discounts? Those might exist in retail, but law firms are a different story.

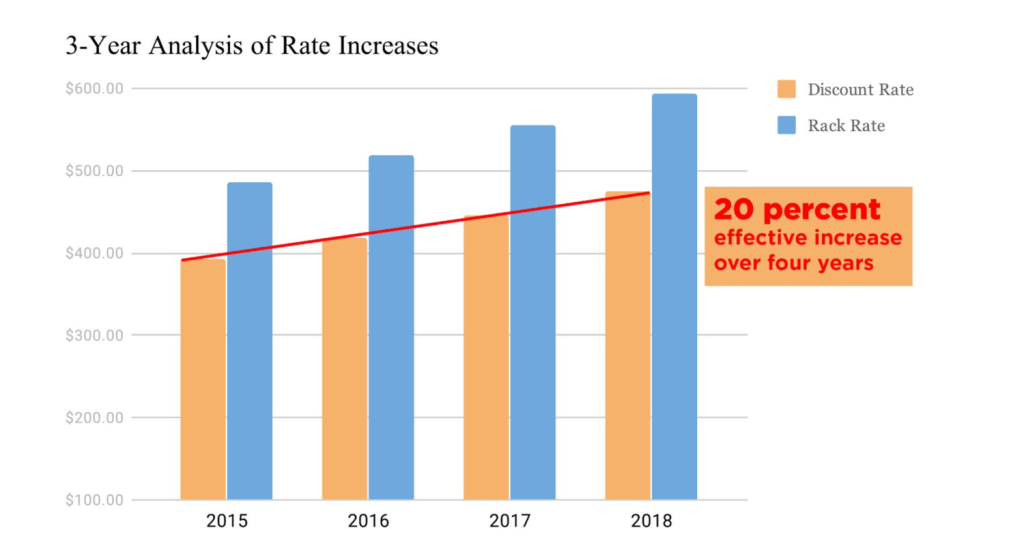

Even when companies find themselves in dire need of competitive pricing, the legal industry continues to respond with inflated fees and a refusal to hold timekeepers accountable. This has a tragic consequence to real people — like employees and suppliers.

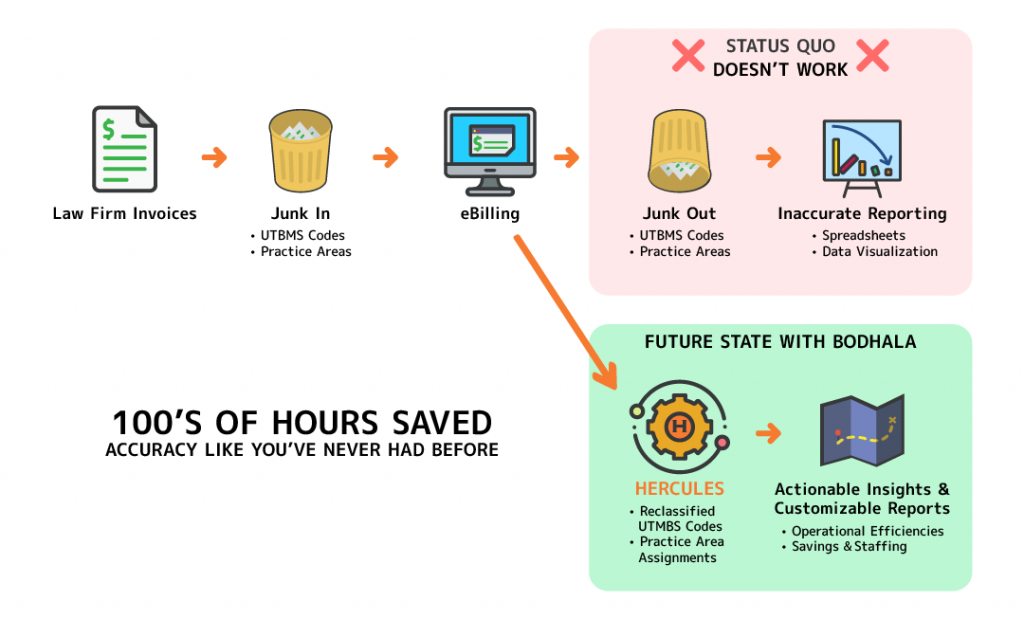

Now is not the time to dig deeper into your company’s pockets to pay the inflated fees law firms are charging. Bodhala’s proprietary data set serves as a valuable resource for companies at risk to ensure they don’t pay out tens of millions of dollars to their law firm while kicking their employees to the curb.

We can all learn a lesson from Toys “R” Us which filed for bankruptcy in 2017.

The beloved toy store chain that was part of so many of our childhoods turned into a feeding frenzy for Big Law as top firm Kirkland & Ellis took home $56 million.

Bodhala data shows that law firm rates for Toys “R” Us were 36.6% higher than similar “bet the company” litigation. These matters are plagued by too many attorneys on each filing, brief, meeting, call, and hearing.

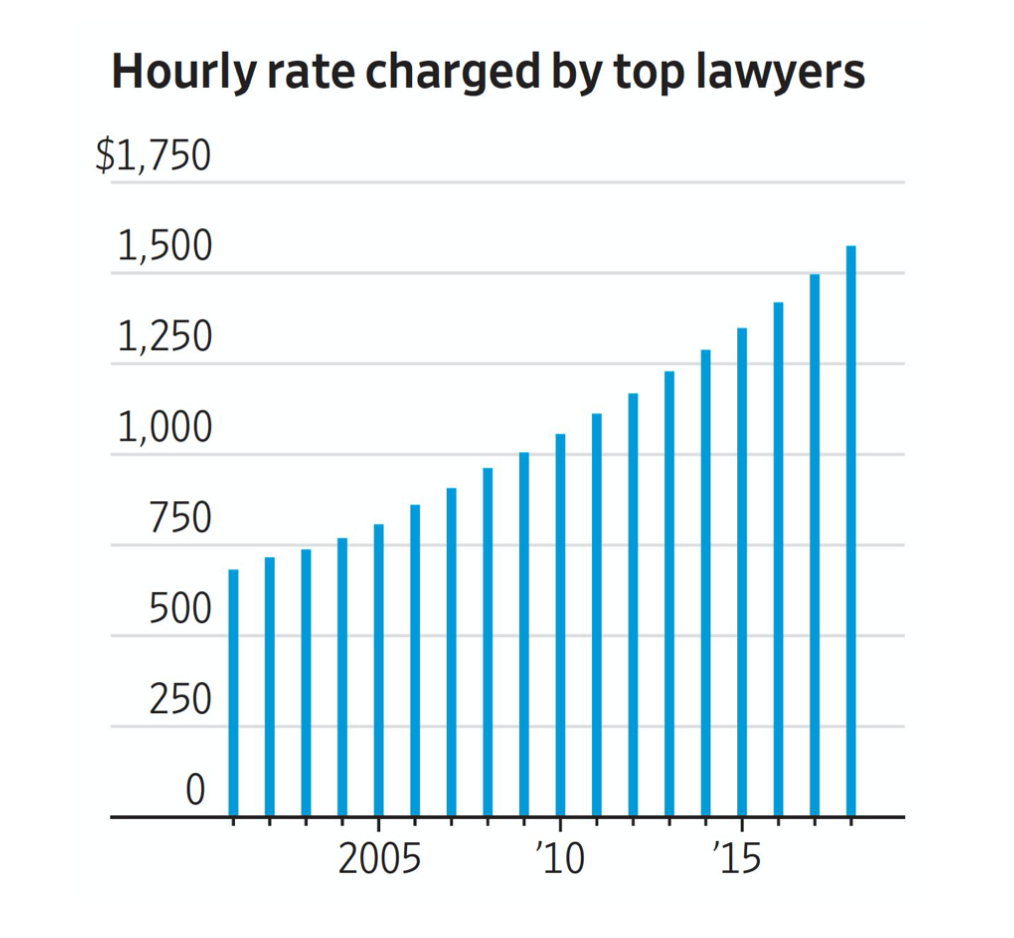

Judge Keith Phillips reviewed and approved the firm’s fee application which listed the top two earners raking in over $3 million dollars while billing hourly rates between $995 and $1,480.

105 partners and 131 associates at Kirkland & Ellis worked on the bankruptcy case with seven partners and associates billing over one million dollars EACH in fees.

What did the Toys “R” Us employees take home you may ask?

The employees who missed out on Thanksgiving dinners to accommodate Black Friday shoppers, those who sacrificed family gatherings to cover a shift, the people who spent their birthdays working instead of celebrating…they must have received something – right?

Think again.

Employees received no severance pay. Nothing.

Did this have to happen? Absolutely not.

The Toys “R” Us bankruptcy was an outrage and led to the public shaming of the management and system that allowed the filing to pan out the way it did.

Yet companies are on track to see this happen again tenfold during the coronavirus pandemic.

The United States Trustee program is a component of the Department of Justice tasked with overseeing the administration of bankruptcy cases. Significant reputation risk is at stake if judges and US Trustees do not ensure rates are reasonable and aligned with other market rates.

So what’s the solution here?

Enter Bodhala.

It is time to hold your service providers accountable, including pricey law firms.

Our market data provides transparency into the billable hour and actionable insights so that the US Trustee can operate effectively — instead of overseeing another massive law firm payday while an entire workforce gets kicked to the curb.

With over $15 billion in legal invoices and data from over 235,000 lawyers spread across 31,000 law firms — with the most sophisticated algorithms ever created in legal spend management — we’re here to ensure that you hire the right lawyer at the right law firm at the right price.

Contact us at [email protected] to learn how Bodhala can help with your spend optimization efforts.